The 6 Best Personal Finance Software of 2017

Best Personal Finance Software – Digest of the Most Popular Platforms

Personal accounting software is a convenient tool for tracking your expenses, investments, bank loans, or bills. Read about our top personal accounting software and see what suits you most.

There is hardly anyone who has never tried to keep track of his or her personal finances. Some people control their bank accounts and credit cards; others keep paper budget sheets or short notes in their smart phones. Yet, the most comfortable and trouble-free way is to use special budgeting software.

Contemporary developers offer numerous types of personal accounting software. Such platforms have many options in common but feature several unique tools as well. And, of course, they differ in their user-friendliness, interface, compatibility with other software etc.

We have prepared a rating of six most popular personal finance trackers, where three platforms are provided free of charge. Let’s discuss main advantages and drawbacks of this software and study their main features.

Free financial software

Free personal finance managers are preferred by almost all users since they enable keeping your home budget without additional expenses. We have selected the following platforms – Mint, Personal Capital, and Cubux.

Cubux

Cubux is one of the best free budget planner. It enables setting financial goals and creating personal budget sheets. The platform features powerful statistical and analytical tools and is very convenient and efficient for all types of users.

Pros: Opportunity to keep family finances.

Cons: Slightly narrow list of financial options.

Hence, there are numerous personal finance software solutions to cater to every taste. The final choice depends on your individual financial habits and your personal approach to home bookkeeping.

Mint

This is highly automated home finance software which offers synchronization with major US and Canadian financial institutions. The app is quick and easy-to-use and features useful ads which can help improve your personal accounting.

Pros: Excellent bill payment tools.

Cons: No percentage-based savings goals.

Personal Capital

Personal Capital is a financial account aggregator that summarizes all information about your bank accounts, credit cards, loans etc. and offers personal financial guidance.

Pros: Convenient options for tax tracking and retirement planning.

Cons: Occasional setting-up problems.

Commercial personal finance software

Many budgeting platforms are available only upon payment but they typically offer a whole lot of interesting tools that can result useful for entrepreneurs and other advanced users. We have studied three such services – Moneydance, YNAB, and Buxfer.

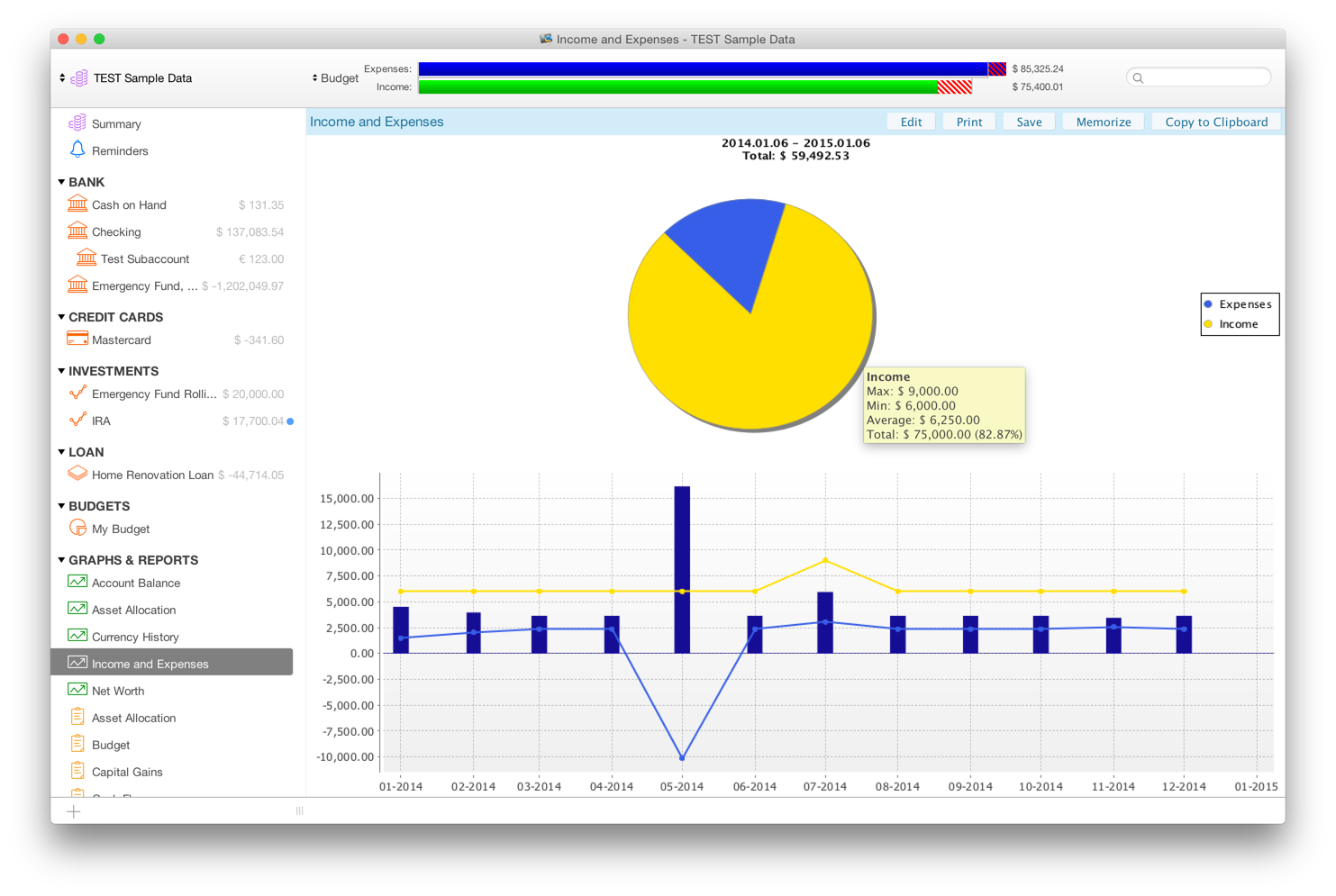

Moneydance

This is an intuitive and straightforward platform with numerous powerful options, such as personal investments, synchronization with various financial institutions, and color-coding. Both desktop and mobile versions are available, including Android and iOS ones.

Pros: Has much more reporting and analytics tools than the majority of other platforms.

Cons: Budgeting goals and retirement-planning tools are missing.

YNAB

YNAB is the acronym for You Need A Budget. This is online personal finance software which is great for those who don’t need many sophisticated options but look for user-friendliness and efficiency. The platform is available on various devices including Apple Watch.

Pros: Offers instructional support for dealing with budgeting problems of any kind.

Cons: No options for tracking personal investments or bills.

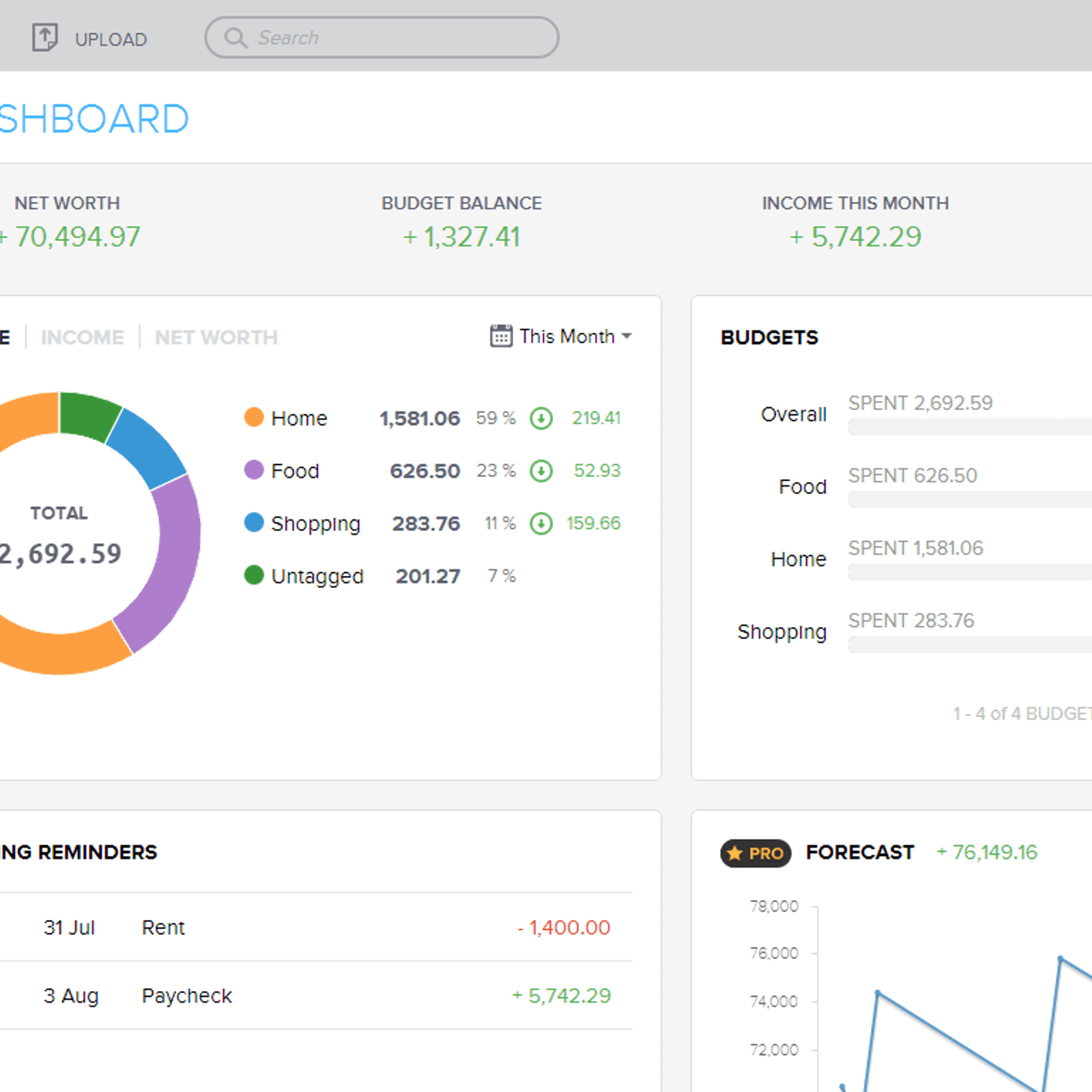

Buxfer

Buxfer is an easy-to-use online home accounting software designed for all types of users. It provides clear graphical statistics, and its colorful interface is free from any redundant information.

Pros: Opportunity to get notifications if something goes wrong with your budget.

Cons: Limited reporting options.

Комментарии

Отправить комментарий